In today’s fast-paced world, managing finances has become more important than ever. Personal budgeting is a crucial skill that everyone should learn to ensure financial stability and security. Whether you’re a student, a working professional, or a retiree, creating and sticking to a budget can help you achieve your financial goals and avoid debt.

In this article, we’ll take a deep dive into personal budgeting and cover everything you need to know to get started. From understanding the basics of budgeting to creating a personalized budget plan, we’ll cover it all. So, let’s get started!

Understanding the Basics of Budgeting

Before we dive into the nitty-gritty of personal budgeting, it’s essential to understand the basics. A budget is a plan that outlines your income and expenses over a specific period. It helps you keep track of your finances and make informed decisions about your spending.

To create a budget, you need to start by calculating your income. This includes all the money you earn from your job, side hustles, investments, and other sources. Once you have a clear idea of your income, you can move on to calculating your expenses.

Expenses are the money you spend on various things like rent, groceries, utility bills, entertainment, and more. It’s crucial to categorize your expenses into fixed and variable expenses. Fixed expenses are those that remain constant from month to month, like rent or car payments. Variable expenses, on the other hand, are those that vary from month to month, like groceries bills or entertainment.

Creating a Personalized Budget Plan

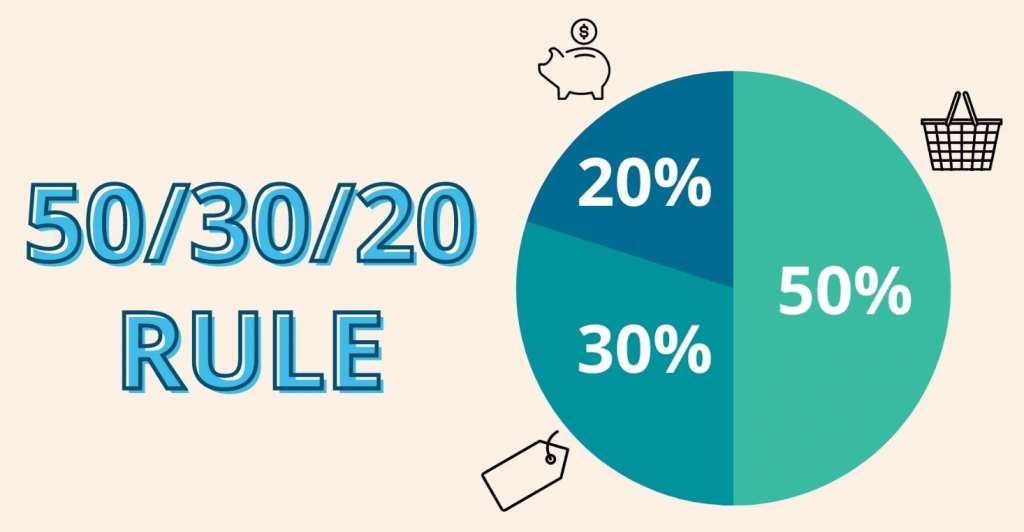

Now that you have a clear idea of your income and expenses, it’s time to create a personalized budget plan. There are several ways to create a budget, but the most popular and effective method is the 50/30/20 rule.

The 50/30/20 rule is a simple budgeting method that divides your income into three categories: needs, wants, and savings. Here’s how it works:

- 50% for Needs: This includes all your fixed expenses like rent, utilities, car payments, insurance, and groceries. Your needs should not exceed 50% of your income.

- 30% for Wants: This category includes all your variable expenses like dining out, entertainment, shopping, and travel. Your wants should not exceed 30% of your income.

- 20% for Savings: This category includes all your savings, investments, and debt payments. You should aim to save at least 20% of your income every month.

Using this method, you can create a personalized budget plan that suits your lifestyle and financial goals. You can use various tools like spreadsheets, apps, or online budgeting tools to create and track your budget.

Tips for Sticking to Your Budget

Creating a budget is only the first step. To achieve your financial goals, you need to stick to your budget. Here are some tips to help you stay on track:

- Track Your Spending: Keep track of your spending to ensure that you’re staying within your budget. You can use a budgeting app or a spreadsheet to track your expenses.

- Avoid Impulse Purchases: Avoid making impulse purchases that are not included in your budget. Stick to your plan and avoid unnecessary spending.

- Review Your Budget Regularly: Review your budget regularly to ensure that it’s still working for you. Make adjustments if necessary.

- Use Cash: Consider using cash instead of credit cards for your variable expenses. This can help you avoid overspending and stick to your budget.

- Stay Motivated: Stay motivated by setting achievable financial goals and celebrating your successes.

Conclusion

Personal budgeting is a crucial skill that everyone should learn to ensure financial stability and security. By understanding the basics of budgeting, creating a personalized budget plan, and sticking to your budget, you can achieve your financial goals and avoid debt.

Remember, creating a budget is only the first step. To achieve financial success, you need to commit to your budget and make it a part of your lifestyle. With the right mindset and tools, you can take control of your finances and achieve financial freedom.